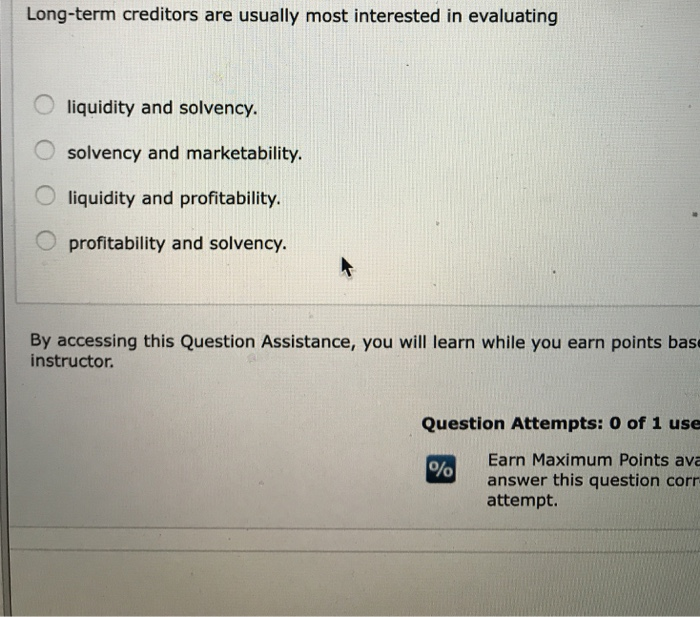

Long Term Creditors Are Usually Most Interested in Evaluating

Long-term creditors are usually most interested in evaluating a. Solvency By signing up.

Solved Stockholders Are Most Interested In Evaluating A Chegg Com

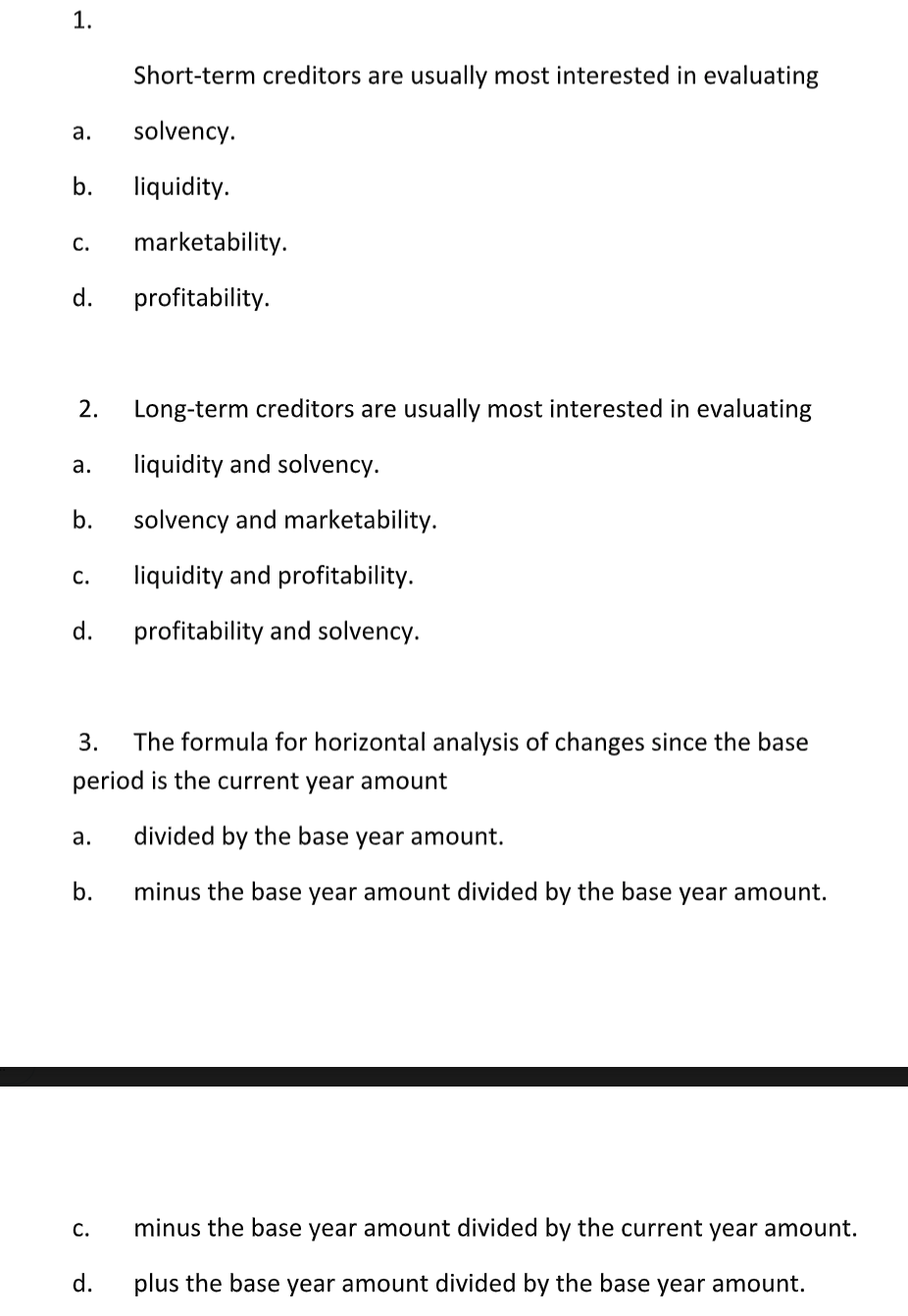

Long-term creditors are usually most interested in evaluating.

. They are not interested in ration analysis. Accounting questions and answers. Trading on the equity leverage refers to the A.

Accounting Questions Long-term creditors are usually most interested in evaluating b. Long-term creditors are usually most interested in evaluating aliquidity and profitability. B solvency and marketability.

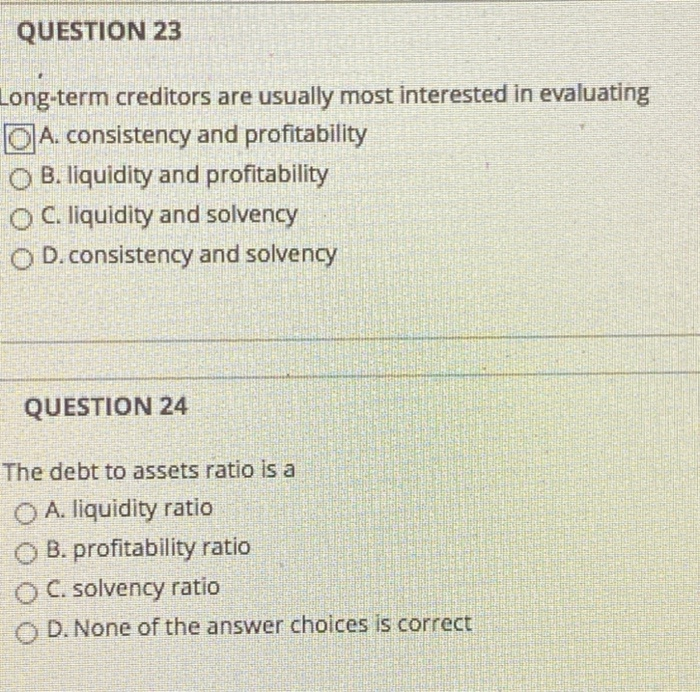

More questions like this A brother and sister held title to a duplex as joint tenants. CES Multiple Choice Question 122 Long-term creditors are usually most interested in evaluating profitability O marketability. D profitability and solvency.

Stockholders are most interested in evaluating. The long term creditors are looking to the company for paying debt in the future. Long-term creditors lenders are usually most interested in evaluating a companys Liquidity and Solvency Stockholders owners are most interested in evaluating.

Long-term creditors are usually most interested in evaluating A. Up to 256 cash back Short-term creditors are usually most interested in evaluating solvency. His ability to pay off his debts as they come due.

Long-term creditors are usually most interested in evaluating a liquidity and solvency. See full answer below. Short-term creditors are typically most interested in analyzing a companys.

Expert Answer 86 7 ratings Long-term creditors such as bondholders loan money for. They look more into profitability and solvency. Long-term creditors are usually most interested in evaluating.

Solvency credit ratios and marketability. Aliquidity measures Ball ratio categories Cprofitability measures Dsolvency measures all ratio categories Which of the following is not a tool in financial statement analysis. Where does egypt sherrod live.

C liquidity and profitability. The long term creditors are transacting with the company for a long term. Examples of estimates normally found in financial statements include.

A young investor willing to take moderate risk for above-average growth would be most interested in. This preview shows page 4 - 6 out of 18 pages. Long-term creditors are usually most interested in evaluating.

Long-term creditors are usually most interested in evaluating. The ability for the company to pay it long term debts. So long term creditors are looking on profitability ratios and solvency ratio to study on it.

Long-term creditors are most interested in a companys ability to pay its obligations into the future. Kattyahto8 and 3 more users found this answer helpful. What are long-term creditors interested in evaluating.

Short-term creditors are typically most interested in assessing. Solvency ratios Interested parties 50. Solvency refers to a companys ability to pay all of its debts.

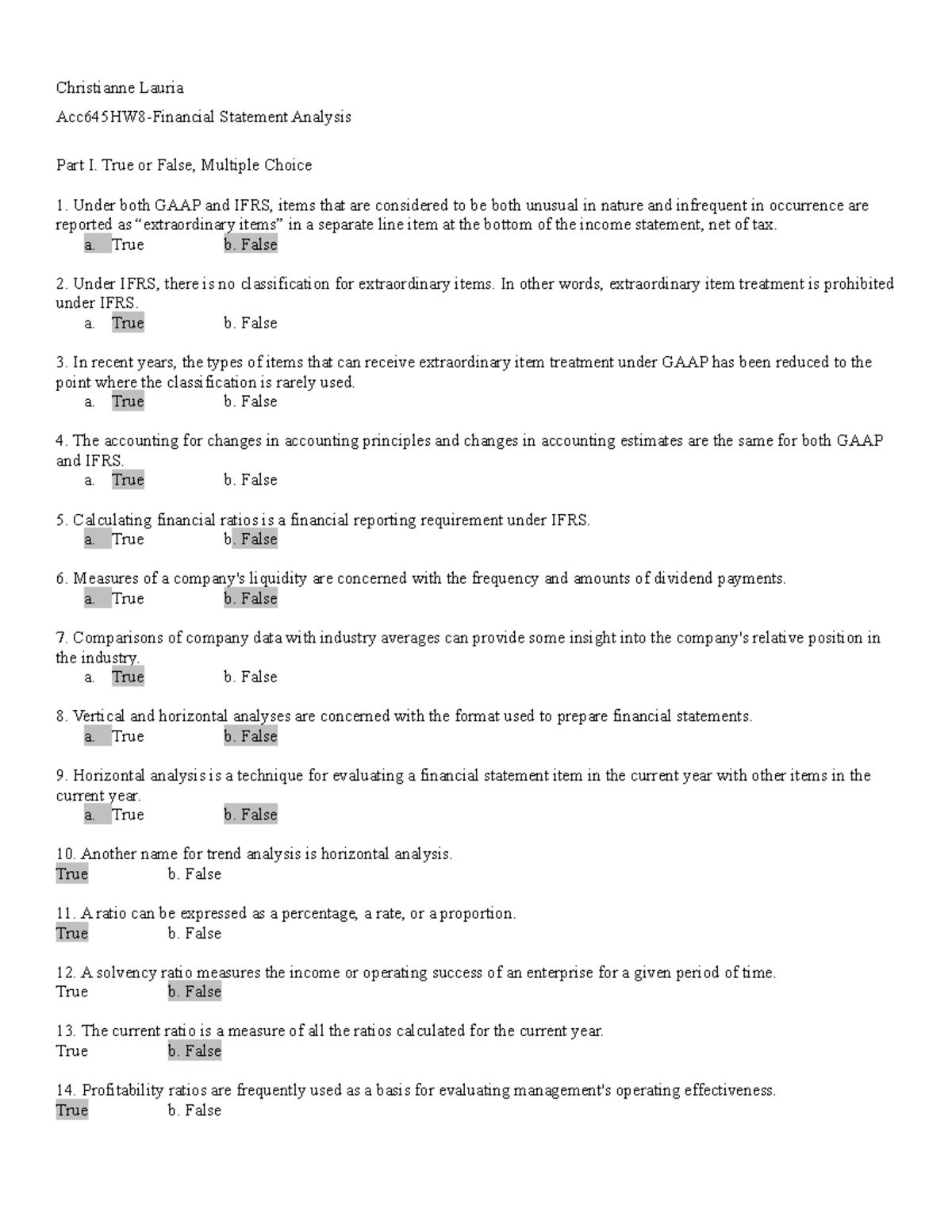

Horizontal analysis is a technique for evaluating a series of financial statement data over a period of time. Question 11 4 points Long-term creditors are usually most interested in evaluating 1 liquidity and profitability 2 consistency and profitability 3 liquidity and solvency 4 consistency and solvency. Liquidity and solvency credit ratios.

Stockholders are most interested in evaluating. View the full answer Transcribed image text. Become a member and.

Other than this property their business and personal affairs were conducted separately. Short term creditors. Long-term creditors are usually most interested in evaluating.

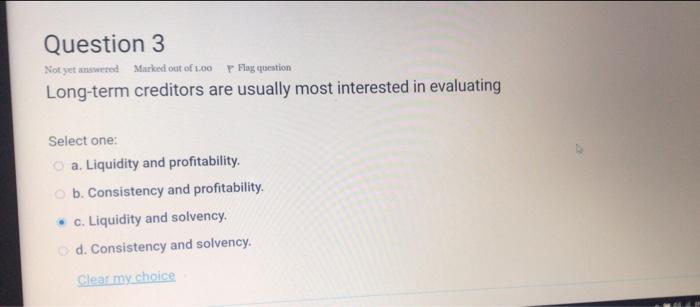

Are primarily interested in a person liquidity. Palm beach gardens weather 10-day. Long-term creditors are usually most interested in evaluating Select one.

When the brother died he was insolvent and owed several creditors substantial unsecured amounts of money. The correct answer is option c. Looks more into a company long term ability to survive.

Amount of working capital. Solvency ratios provide information that long-term creditors can use to assess the risk of lending to a company. Avril 2 2022 avril 2 2022.

Existing and potential long-term creditors are usually interested in evaluating the liquidity.

Solved Short Term Creditors Are Usually Most Interested In Chegg Com

Solved 1 Short Term Creditors Are Usually Most Interested Chegg Com

The Elements Of A Bond Form Bond Element Form

76 Short Term Creditors Are Usually Most Interested In Assessing A Liquidity B Course Hero

Ch01 Solution W Kieso Ifrs 1st Edi

76 Short Term Creditors Are Usually Most Interested In Assessing A Liquidity B Course Hero

Management Is A User Of Financial Analysis Which Of The Following Comments Does Course Hero

Financial Statement Analysis T F Acc645hw8 Studocu

Career Options For Aspiring Accountants Infographic Accounting Degree Accounting Career Path

Sources Of Debt Financing Finance Debt Finance Debt

Solved Question 23 Long Term Creditors Are Usually Most Chegg Com

Ratios Of Interest To The Short Term Creditor Video Lesson Transcript Study Com

Solved Question 3 Not Yet Answered Marked Out Of 1 00 Chegg Com

Chapter 7 Pdf Equity Finance Revenue

Solved Ces Multiple Choice Question 122 Long Term Creditors Chegg Com

76 Short Term Creditors Are Usually Most Interested In Assessing A Liquidity B Course Hero

Question 23 Long Term Creditors Are Usually Most Interested In Evaluating O A Consistency And Profitability O Homeworklib

Solved Long Term Creditors Are Usually Most Interested In Chegg Com

Ratios Of Interest To The Long Term Creditor Video Lesson Transcript Study Com

Comments

Post a Comment